Malaysia Today - Your Source of Independent News |

| The Auditor-General’s Report and Debt Management: Anwar vs Najib Posted: 25 Oct 2011 06:06 PM PDT Fiscal deficit is not always bad. However, persistent fiscal deficits even when economy is growing – meaning there's a serious lack of fiscal discipline – would weaken a government's position to meet its debt obligation later on, especially in time of recession. And when this happens, that means the future generation will be burdened with ballooning public debt. By William Leong Jee Keen, Member of Parliament, Selayang In collaboration with Political Studies for Change (KPRU – Kajian Politik untuk Perubahan), a local research institute as well as a political think tank. Persistent fiscal deficits! That's the best description of the Federal Government's fiscal position which had been governed by Barisan Nasional (BN) over past few decades except a brief period of federal budget surplus from 1993 to 1997 when Anwar Ibrahim was the Finance Minister. This year's much-delayed Auditor-General's Report again revealed wasteful spending by government departments as well as weaknesses of governance which have contributed to the Federal Government's embedded deficit and debt problems. The report's specific remark on rising trend of public debt which is approaching alarming level is a serious issue. Due attention shall be given to the questionable debt management capability by the BN Government. Fiscal deficit is not always bad. However, persistent fiscal deficits even when economy is growing – meaning there's a serious lack of fiscal discipline – would weaken a government's position to meet its debt obligation later on, especially in time of recession. And when this happens, that means the future generation will be burdened with ballooning public debt. Mathematically, drafting a national budget very much depends on a country's economic growth projection over next year and thus its nominal value of Gross Domestic Product (GDP). A robust growth will mean higher GDP and higher revenue as tax and other revenues go up. That will provide a smaller value of budget deficit forecast and of course a smaller percentage of public debt. However, when economic growth projection is over-optimistic or when economy is slowing down, that will mean smaller-than-anticipated tax and other revenues, hence, the actual nominal value of GDP is smaller, driving the shortfall higher. That will provide a bigger value of budget deficit and thus a higher percentage of public debt. The world economy is on a downward spiral. As one of the most open economies and very dependent on international trade, various growth projection of Malaysia for next year is significantly lower despite Prime Minister Najib Razak's over-optimistic growth forecast of 5.0 to 6.0 percent and budget deficit forecast of 4.7 percent for 2012 in his proposed RM232.833 billion Budget 2012 tabled on the 7th of October, 2012. Most research houses have lowered their 2012 growth projections for Malaysia despite Najib's optimism in his 2012 Budget proposals, which critics have said is primed for the imminent 13th General Election. Against this background, the Malaysian Institute of Economic Research (MIER) downgrades 2011 GDP growth rate to 4.6 percent year-on-year. For 2012, MIER revises the GDP growth forecast to 5.0 percent.1 According to the RHB Research Institute, Malaysia's economic growth could slow to just 3.6 percent next year from a projected 4.3 percent this year due to the increasing risk of a double dip global recession. Given the projections and path we are currently on, that means even higher deficits than we have now. Worse than the worst, if we go into a recession, we will see record-level deficits and public debts. By that time, as the government's debt obligations are mathematically impossible to resolve, the rakyat will then wake up one morning to the reality that they are a lot poorer than they thought. According to the 2010 Auditor-General's Report released on 24 October 2011, Malaysia's public debt rose by 12.3 percent or RM44.72 billion to RM407.11 billion last year compared to RM362.39 billion in 2009. The Auditor-General said in the report that the government owed 53.1 percent of GDP, slightly down from 53.3 per cent last year. That's the second consecutive year the Federal Government debt to GDP ratio surpassing the 50 percent level. By referring to the following chart provided in the 2010 Auditor-General's Report, public debt from domestic sources rose by RM41.76 billion to RM390.36 billion while external debt rose to RM16.75 billion, up RM2.96 billion. Sources: 2010 Auditor General's Report. It is in this context that I shall try to argue that, fiscal discipline and prudent debt management of the government of the day should be taken seriously as the most basic and important elements of good governance. In the following chart, Federal Government deficits figure compiled by a local research institute as well as a political think tank Political Studies for Change (KPRU – Kajian Politik untuk Perubahan) has shown that, there's a serious lack of fiscal discipline in the Federal Government under the administration of then Finance Minister Mahathir Mohamad, later Abdullah Ahmad Badawi and now Najib Razak. It is worth noting that the country has been in deficit for 14 consecutive years, and this is set to continue in 2012. This trend started in 1998 in the aftermath of the Asian financial crisis, which coincided with the sacking of Anwar, the Finance Minister and Deputy Prime Minister at that time. In fact, ever since Anwar was appointed Deputy Prime Minister in 1993, the country's budget had been in surplus every year until his sacking. After being appointed Finance Minister in 1991, Anwar turned the budget deficit into surplus in two years' time, which was no mean feat as the country's account had been in deficit for more than 20 years before his helming of the treasury2. A brief period of surplus was recorded and they were 0.2 percent in year 1993, 2.3 percent in year 1994, 0.8 percent in year 1995, 0.7 percent in year 1996 and 2.4 percent in year 1997. In contrast, current government under the administration of Najib has run on budget-deficits with increasing Federal Government debts. Source:

When one takes a deeper look into the numbers, one has to say that Anwar's record as Finance Minister is indeed impressive. Total Federal Government debt actually decreased from 1992 until 1996 after more than 20 years of consecutive increases8. The total Federal Government debt level had also been kept between RM89 billion to RM100 billion from 1991 to 1997. In the Anwar era, besides a 4.6 percent increase in Federal Government debt in his first year as Finance Minister, and a 0.3 percent surge and 14.7 percent surge in 1997 and 1998 respectively when the country was badly hit by the economic crisis, the debt level had been decreasing at a stable rate of 1 to 3 percent every year. In contrast, total Federal Government debt had been increasing rapidly at a rate of more than 10 percent every year since Najib became Finance Minister in 2008. To make things worse, the BN Government has a tendency to approve supplementary budgets in dealing with over-spending one after another, quite often without valid ground. The basic principle to table a supplementary supply bill is when unexpected expenditure takes place especially when a country is in a crisis like the earthquake and nuclear disaster in Japan. However, having been criticized for over-spending and persistent budget deficits, the BN Government has manipulated the supplementary budget as a political tool to hide escalating deficit and debt figures during annual announcement of the National Budget rather than as an avenue in dealing with unexpected spending. For example, in the latest Supplementary Supply (2011) Bill 2011 tabled in June this year, the Najib administration had been criticized for manipulating RM1 billion of allocation for emolument of Health Ministry as emolument shouldn't fall under unexpected spending. That's also one main reason why initial forecast of deficit figure announced during annual budget session used to be lower than the actual one. The following tables compiled by KPRU have shown that, the BN Government has tabled two supplementary supply bills outside the 2009 National Budget, another two supplementary supply bills outside the 2012 National Budget and up until today, one supplementary supply bill outside the 2011 National Budget. Although the 2012 National Budget has just been tabled, past records show that the BN Government could table another supplementary supply bill outside the 2011 National Budget during current parliament session or in year 2002. KPRU STATISTIC: ACTUAL ALLOCATION FOR YEAR 2011 NATIONAL SPENDING (UP-TO-DATE)

Source: Supply Bill and Supplementary Supply Bill. KPRU STATISTIC: ACTUAL ALLOCATION FOR YEAR 2010 NATIONAL SPENDING

Source: Supply Bill and Supplementary Supply Bill. KPRU STATISTIC: ACTUAL ALLOCATION FOR YEAR 2009 NATIONAL SPENDING

Source: Supply Bill and Supplementary Supply Bill. On the 7th of October, 2011, in a politically staged event of utmost importance to his own survival as well as UMNO-BN, Najib gave a positive prognosis of the Malaysian economy by proudly claiming a projected 5.0 to 5.5 percent growth rate for 2011, and then unrealistically projecting a 5.0 to 6.0 percent growth rate for 2012. On top of that, Najib also touted a reduction of the federal fiscal deficit to 4.7 percent of the GDP in 2012 from 5.4 percent in 20119. Missing from his speech was any mention of our national, external, or total Federal Government debt. In fact, the last time any of this was mentioned in a budget speech was two years ago in 2009, when Najib conceded that the rate of our national debt was getting higher and higher10. 2009 was also the year in which the total Federal Government debt recorded a marked increase to 53.3 percent of the GDP from 41.3 percent the year before. The Federal Government debt to GDP ratio had maintained at rate of around 53 percent to 54 percent since then, with the 2011 figure projected at 53.8 percent11. According to Bank Negara Malaysia's latest report, as of 30 June 2011, Federal Government debt stood at RM437 billion, with domestic debt amounting to RM421 billion and foreign debt at RM16 billion. According to the 2010 Federal Government Financial Statements prepared by the Accountant General of Malaysia, for the year 2010, total Federal Government debt increased by 12 percent to RM407.101 billion as against RM362.386 billion in 2009. Borrowings increased by RM45.062 billion or 13 percent to RM399.711 billion from RM354.649 billion in 2009. Reacting to the latest debt figures, Parliamentary Opposition Leader Dato' Seri Anwar Ibrahim warned that Malaysia was on course to breach the public debt limit due to the Federal Government's failure to resuscitate the country's under-performing economy12. Based on the Government Funding Act 1983 and Loan (Local) Act 1959, currently, the ceiling under both Acts is not more than 55 percent of total GDP. In addition, external loans are obtained with limits of borrowing based on the External Loans Act 1963. Currently, the ceiling under the Act is RM35 billion. Viewing the situation from another perspective, we turn to the work of Carmen Reinhart and Ken Rogoff entitled 'This Time Is Different: Eight Centuries of Financial Folly'. They studied the factors contributing to 29 past sovereign defaults and found that default or debt restructuring occurred, on average, when external debt reached 73 percent of Gross National Product (GNP). Note: 2011 figure is based on estimate. Source: EPU 13 14 15 16 (1991-2008), MOF Economic Report 17 18 (2009-2011). Based on the above chart compiled by KPRU, total Federal Government debt was RM99.073 billion in 1991, the year Anwar became Finance Minister. It dropped to RM97.005 billion in 1992, RM95.898 billion in 1993, RM93.078 billion in 1994, RM91.369 billion in 1995, and RM89.681 billion in 1996, before it rose minimally to RM89.920 billion in 1997, and more significantly to RM103.121 billion in 1998. Total Federal Government debt was RM306.437 billion in 2008 when Najib took over as Finance Minister. It rose to RM362.387 billion in 2009 and RM407.101 billion in 2010. It was projected to hit RM455.745 billion in 2011. According to Bank Negara Malaysia's latest report, as of 30 June 2011, Federal Government debt already hit RM437 billion. Note: 2011 figure is based on estimate. Source: EPU 19 20 (1991-2008), MOF Economic Report 21 22 (2009-2011). Based on the above chart compiled by KPRU, the reasonably well managed debt levels during Anwar's time as Finance Minister can be attributed to sound management of the domestic debt. Anwar had managed to keep the domestic debt level below RM80 billion until 1997 until it hit RM88.197 billion in 1998. In the seven-year period from 1991 to 1998, domestic debt rose by a total of RM14.542 billion or 19.7 percent, with the bulk of it coming from the period of 1997 to 1998. From 2008 to 2011, in a short span of three years, domestic debt rose by a total of RM152.346 billion or 53.2 percent. This shows that the domestic debt level rose sharply since Najib took over as Finance Minister until now. Note: 2011 figure is based on estimate. Source: EPU 23 24 25 26 (1991-2008), MOF Economic Report 27 28 (2009-2011). In fact, Najib's debt management seems to be worse than his predecessor, Abdullah Ahmad Badawi's. Based on the above chart compiled by KPRU, the total Federal Government debt grew 5.6 percent and 5.9 percent in 2005 and 2006 respectively, and they were the smallest since an 8.7 percent increase was recorded in 1999. Note: 2011 figure is based on estimate. Source:

Based on the above chart compiled by KPRU, the period in which Anwar was at the helm of the Treasury also saw a remarkable decrease in the Federal Government debt to GDP ratio, from 73.3 percent in 1991 to 31.9 percent in 1997. In contrast, Najib's helm of the same office was marked by an increase of more than 10% in the Federal Government debt to GDP ratio from 2008 to 2009. The numbers do show that Anwar is a more prudent and effective manager of the economy as compared to Najib. Najib can point to the weakness of the global economy time and time again, but the increase in spending, and more specifically, extravagant spending in the wrong areas and money-corrupted governance seems to be the reason for our continuing high debt level. How much public money has been lost through corruption? How much of it has been used to subsidise big corporations instead of the people? How much of it has been used to pay for 'commission' for big business deals involving the government? We may never know how much, but we do know that it is one hell of an amount. A corrupt governments' moral or legal right to bind future generations of citizens to repay foreign creditors is questionable. The problem is that this is the beginning of a string of crises and not the end. It's time that a government practicing good governance vis-à-vis debt management is being put in place so as to safeguard a better tomorrow for future generation of Malaysia. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

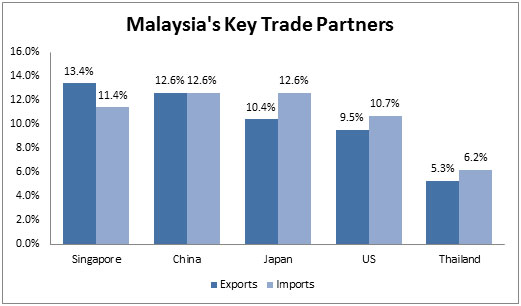

| The China Alternative – Malaysia Posted: 25 Oct 2011 05:49 PM PDT By Cindy Tse, China Briefing Oct. 25 – The Malaysian government recently announced an ambitious goal to become a high-income nation by 2020, necessitating equally bold changes to the country's social and economic policies. The state's reform program, the New Economic Model, was launched in March of 2010 and involves ambitious schemes to restructure the economy and pull it out of low value-added manufacturing and increase private investment. The NEM is just one of four economic programs to come out of Prime Minister Datuk Seri Najib Razak's office in 2010. The Tenth Malaysia Plan will direct the state's public sector capital expenditures, the Government Transformation Program will address corruption and issues with Malaysia's social welfare provisions, and the Economic Transformation Programs will be dedicated to spurring growth in foreign and domestic private investment. Background Malaysia is governed as a constitutional monarchy, though Peninsular Malaysian states retain hereditary rulers who are often referred to as "Sultans." The capital city is Kuala Lumpur, a bustling metropolis of 1.6 million. Malaysia's population of 28.7 million is comprised of three main ethnic groups – Malay, Chinese and Indian. As would be expected in a society where multiple cultures and religions co-exist, relations between various groups are not always harmonious. However, in the case of Malaysia, most policy changes have to take into account the effect on the often competing interests of these ethnic groups. English is widely used as a second language, particularly in the workplace, making Malaysia a relatively easy place for foreign enterprises to operate in. Most Malays are multilingual, with Bahasa Malaysia as the official national language. Various mother tongue languages are spoken as well, such as different dialects of Chinese, Tamil, or Bahasa Indonesia, which is quite similar to Malaysia's official first language. Economy The country's account balance is in a comfortable position, with its US$34.14 billion surplus ranked 13th in the world – though naturally a minor point when compared with China's US$305.4 billion surplus. Aside from the United States, Malaysia's trading partners are highly concentrated in the Asia-Pacific region, with Singapore, China, Japan, Thailand and Hong Kong having the highest shares of imports and exports.

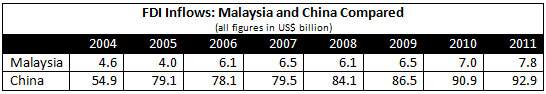

Investment climate Given the highly racialized nature of politics in Malaysia, governments throughout much of Malaysia's recent history have been quite cautious in enacting policies to encourage FDI. Since the 1970s, there has been a "30 percent equity rule" in Malaysia, which requires 30 percent equity of any enterprise to be held by a Bumiputra – an ethnic Malay or indigenous person. The purpose of the policy was to increase Malays' share of the nation's wealth to a fair 30 percent. And while the government maintains that it has yet to reach this target (they claim Malay ownership is at 18.9 percent), studies on the subject say the 30 percent target may have already been surpassed. Since 2009, there have been more and more exceptions to these Bumiputra ownership rules. Investment in the manufacturing sector, 27 non-controversial services sub-sectors, and investment in the Iskander Development Region are exempt. Prior to 2009, all initial public offerings (IPO) on the Bursa Malaysia were required to set aside 30 percent for purchases by Bumiputra. This 30 percent has since been reduced to 12.5 percent for new listings of foreign-owned corporations. While there are substantial incentives offered by the government to encourage foreign investment, they are not without performance requirements, and they certainly won't last forever. Specific requirements are incorporated directly into each individual business license for both foreign and domestic investors. These can include export targets, local content requirements, and mandatory transfers of technology. In 2003, in an effort to increase investment in high value-added sectors, the government extended the existing tax exemption from 10 to 15 years for firms that qualified for "Pioneer Status." This status is given to enterprises involved in specific geographical regions, as well as products or services deemed by the government to be of high priority for development. There is also a more modest 5 to 10 year tax holiday in some lower priority sectors under the "Investment Tax Allowance" scheme. These incentives are said to be provisional, though it's unclear when they will expire. As part of the 2010 Economic Transformation Program, the state has selected 13 sectors in which to boost private investment, though it remains to be seen how welcome foreign participation is in these plans. These sectors include electronics, medical devices, green energy, machinery and equipment, oil and gas, and transportation equipment. Resource-based industries and services like logistics are also targeted sectors.

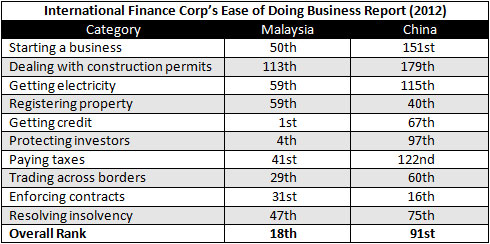

Doing business in Malaysia Malaysia has been climbing in the rankings gradually, bolstered by the ease of getting credit in the country (ranked 1st overall) and its protection of investors (4th). Its recent jump into the top 20 can be attributed to this past year's dramatic improvements in the ease of starting a business (from 111th in the 2011 rankings to 50th this year) and enforcing contracts (from 60th to 31st).

Starting a business in Malaysia has become significantly faster, easier and cheaper over the last few years. In 2006, it took an average of 37 days, 10 procedures and 25.1 percent of the average Malaysian's income to start a business. Now, just five years later, it takes only 6 days, 4 procedures, and about 16.4 percent to get your business off the ground. Online filing of registration documents started in 2009 with more and more procedures done online each year. As of this year, companies can register various business and tax documents with the government's "SSM e-lodgement" web service 24 hours a day. However, as is the case with China, the difficulty of dealing with construction permits in Malaysia – where a process like acquiring building plan approvals can take up to 90 days – contributed to keep Malaysia behind other Asian countries including Singapore, Hong Kong (2nd) and South Korea (8th). Another major deterrent for potential investors in Malaysia is the weak enforcement of patents. Without a special court dedicated to dealing with patent infringements, one cannot be certain that innovations will be protected. Labor Aggregate numbers on the legal work force in Malaysia are slightly worrying, as their productivity growth is low (3.3 percent) compared to that of China's (8.7 percent), which is the highest globally and has risen steadily. However, Malaysia's advantage over China might be its low turnover (5 percent) and wage inflation (5.5 percent). With China's highly mobile workforce, some enterprises in concentrated industrial zones in China's manufacturing hubs complain of extremely high turnover, such that competitors are merely swapping workers and raising salaries. Official estimates show average wage increases of 13 percent per year since 2005. Enterprises in Malaysia can expect to retain their employees longer with more stable wage increases. In addition to this sustained labor shortage, it's the state's fluctuating policies on immigration and labor that have led many companies – local and foreign alike – to relocate their businesses outside of Malaysia. The government has at various times cracked down severely on illegal workers. In 2006, Malaysia saw periodic raids from government task forces attempting to flush out illegal immigrants. One factory alone was found to be employing around 1,500 illegal immigrants. More recently, during the global economic recession in 2009, the government enacted a complete ban on new hires of foreign employees in the manufacturing and services sectors, which was subsequently lifted. Investors are currently waiting on legislation proposed in June of 2011 to offer amnesty to the existing illegal workers in Malaysia, thereby increasing the legal labor pool. For the state, the dramatic move will raise much-needed tax revenues, improve national security, reduce human trafficking, and most importantly, attract more foreign investment. Naturally, this proposal has faced staunch opposition from Malay nationalists, whose interests lay with the rights of local workers. Nonetheless, until a decision is made official, employers should be cautious in knowingly hiring illegal migrants, as the government reportedly performs approximately 16,000 canings per year, many of which are on illegal migrants working in Malaysia's manufacturing, agricultural and services sectors. The law also stipulates caning as the maximum punishment for an employer who hires illegal workers, though an offending employer has yet to receive the brutal lashing. In addition to shortages in low-skill labor, Malaysia's labor force also suffers from a sustained "brain drain," as talented and highly-skilled professionals have been lured overseas by seemingly better job opportunities. From March 2008 to August 2009 alone, an exodus of 304,358 Malaysians did little to help the growth of the nation's economy, as the majority of those who left were professionals. The newly established Talent Corp Agency under the Prime Minister's office will create programs and incentives to encourage the country's nationals engaged in key sectors and professions to return home. The World Bank estimates that approximately 1 million Malaysian nationals are currently working overseas, with 60 percent of those surveyed by the World Bank citing "social injustice" as the primary cause for Malaysia's brain drain. Many of Malaysia's most talented and experienced professionals settle in Singapore instead for its stable and financially promising work environment. It remains to be seen how the government will balance the need to build a highly-skilled labor force when higher education levels remain relatively low compared to the former East Asian Tigers, such as Korea, Taiwan and China. Free trade zones and free trade agreements In order to make use of the ASEAN free trade area's Common External Preferential Tariff rates, there is a procurement requirement that 40 percent of a product be sourced from ASEAN member states. Manufacturing and storage activities in these FIZs and FCZs can often be difficult, as approvals from the zone's administrators are required for different activities. Operating factories and warehouses outside these zones gives a greater range of freedom. Malaysia is a member of the ASEAN Free Trade Area, and has seen significant growth in trade with AFTA member states, which include Indonesia, the Philippines, Singapore, Thailand, Brunei Darussalam, Cambodia, Laos, Myanmar, and Vietnam. Through ASEAN, Malaysia has also signed multilateral trade agreements with a number of trade partners such as China, India, Korea, Japan, Australia, and New Zealand. A few promising FTAs with Chile (2010) and the European Union (under negotiation) bode well for the country's hopes to improve its trade surplus and find comparative advantage in high value-added sectors. Transportation Real estate The Malaysian government has started a program to induce foreigners to relocate to the country with the "Malaysia, My Second Home" program, which offers 10 year visas with property purchases above RM400,000 (approximately US$128,000). Other privileges under the program, like duty-free car purchases, sweeten the deal further for those whose investments in the country might keep them there for a long period of time. While prices are on the rise, particularly in Kuala Lumpur, they are nowhere near the prices one can invariably expect to find in nearby Hong Kong, Singapore, and Shanghai. Conclusion

|

| You are subscribed to email updates from Malaysia Today - Your Source of Independent News To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Malaysia Today - Your Source of Independent News

Malaysia Today - Your Source of Independent News

0 ulasan:

Catat Ulasan